Where do you go-to to keep your car in tip-top condition? The Mechanic!

So, where do you go-to manage your business’s Accounting? Do you do it yourself? Of course, you can. But, are you the best person for the job? You probably know your industry, customers, products and services like the back of your hand. But, do you know the ins-and-outs of ACRA and IRAS requirements? Probably not!

Below are the key reasons why SME turn to outsource their accounting to a professional Accounting Firm:-

1. Save Costs

Hiring full-time accounting staff in-house is costly. You not only have to incur a fixed salary cost but also its incidental costs such as staff training, staff benefits and turnover. More often than not, a full-time certified accountant in-house for a SME is hard to find, train and retain.

Engaging an accounting firm or outsourcing your accounting can save costs as they typically base their fees on the volume of transactions and time spent on providing support.

2. Access to professional knowledge & avoid penalties

Accounting firm has the rich and in-depth knowledge of the local legal and fiscal requirements, the much-complicated accounting policies and practices, the various ACRA and IRAS timelines and requirements. Incorrect filing, missing deadlines or an incorrect understanding of local regulations may lead to non-compliance and heavy penalties and fines. For example, do you know that any business that gives incorrect information in its GST return may be liable to a penalty that is twice the amount of tax undercharged. Furthermore, a jail term may also be imposed. Outsourced accounting surely offers scalable service options that not only provides efficiencies but also a peace of mind.

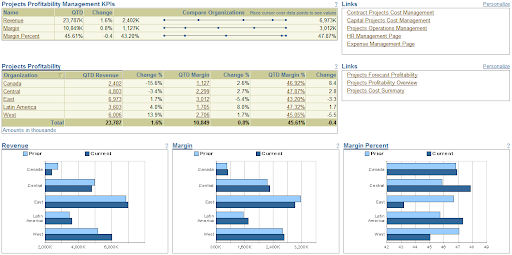

3. Understand your company’s finances

Do you know your financial health beyond bank balances? Accounting firm can define the various financial measurements and reports to analyse the financial health (such as gearing ratio, current ratio, etc) and provide insightful advice such as project costing and profitability.

Conclusion

There is no doubt in today’s age to outsource your accounting to a professional accounting firm in Singapore. Outsourcing accounting definitely frees up your time to focus on the key aspects of the business that drive sales and service and, ultimately, profitability.

Still not too sure? Contact Accounting Consultancy for the best advice and solutions. We have helped many SMEs over the years to reduce costs and improve productivity. As the trusted accounting firm in Singapore, we have a team of dedicated certified Accountants to provide you with professional accounting services.